OVERVIEW

According to RBI regulations, banks are expected to extend their banking services to the unbanked/rural population. However, this noble aim throws up many questions.

How can banks, which have experience only in operating their own branches, set up Business Correspondent (BC) operations in a country with such diverse and dispersed geographies? How can banks successfully set up branches that can conduct brisk cash in/out business every day and scale up by cost effectively setting up sufficiently dense network of branches? How would the banks meet the demands for trained resources to manage these branches?

To help banks tide over these challenges, RBI, as part of its financial inclusion policy, has allowed banks to deploy Business Correspondents and Business Facilitators to expand their footprint and reach to the unbanked/rural sections of the country.

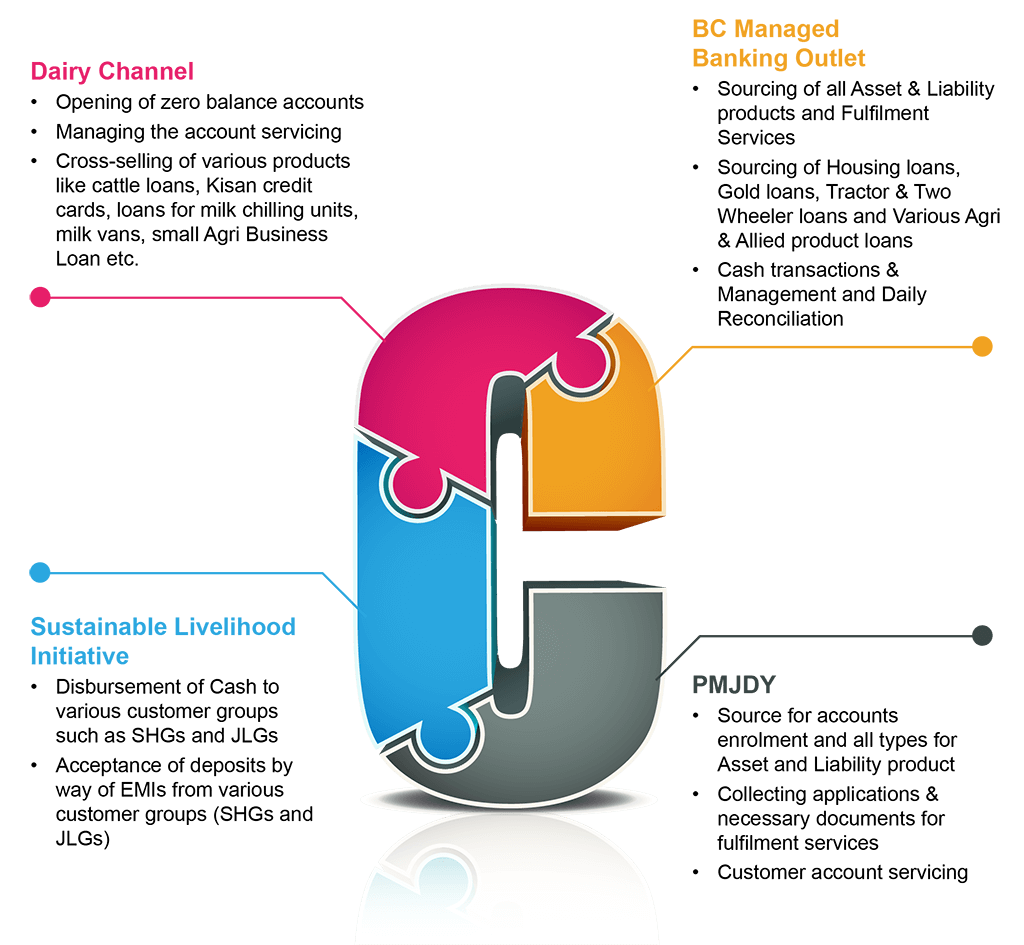

Centillion through its Rural banking services offers its Business Correspondent services in the areas of assets and liabilities sourcing, service points set-up and operations (fixed and mobile), disbursement and EMI collection to and from SHG and JLG, product and process training services, thereby helping banks to reach its customers in unbanked areas in villages of rural India. The services offered by Centillion can be classified under the following categories:

- Business Correspondent Service Points set-up and operations – Premise set-up, manpower deployment, and cash and transactions management.

- Asset and allied products sourcing – Agri loans, TW/Tractor Loans, Cattle Loans, etc.

- Liability sourcing – Source for account enrolment, RD, FD.

- Training delivery in key intervention areas like assets products and services.