| Features |

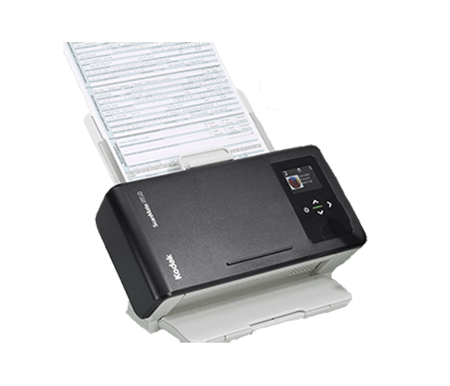

Kodak-i1190EW Scanners |

| Network Setup |

Scanner serves up Web pages and RESTful API to configure connectivity and generate EasySetup pages. EasySetup – Setup scanner on wireless or Ethernet network by scanning an encrypted QR code document. Host Setup application configures host PC use of scanner. |

| Connectivity |

USB 2.0 High Speed, USB 3.0 compatible, Wireless 802.11b/g/n, Ethernet 10/100 Base T |

| Connectivity Modes |

USB Only, Wireless Infrastructure Only, Wireless Ad-hoc Only, Ethernet Only, USB and Wireless Ad-hoc, Ethernet and Wireless Ad-hoc |

| Wireless Modes |

Wireless Infrastructure mode, Wireless Ad-hoc mode (scanner is used as a virtual access point) |

| Wireless Security Features |

WEP (64/128 bit), WPA-PSK (TKIP/AES), WPA2-PSK (TKIP/AES), HTTPS for RESTful API or Open |

| Integration |

Standard: TWAIN and ISIS drivers allow scanning over a network as a shared device Web API: easily integrates with Web HTTP applications without any host drivers, supports HTTP and HTTPS (private key) |

| Smart Touch |

Scan to Folder, Scan to Email, Scan to Print, Scan to Mobile, Scan to WORD, Scan to EXCEL, Scan to Picture Folder, Scan to Applications, Scan to FTP, Scan to Cloud (Dropbox, Evernote, Google Docs, Salesforce, SugerSync, SharePoint, OneDrive, OneNote, Box), Scan to Web Folder (WebDAV) |

| Automated Image Correction & Enhancement |

Perfect Page Scanning; Fixed Cropping; Relative Cropping; Multi-Lingual Auto Orientation; Orthogonal Rotation; Add Border; Remove Border; Intelligent Image Edge Fill; Background Color Smoothing; Automatic Brightness/Contrast; Automatic Color Balance; Round/Rectangular Hole Fill; Sharpening; Streak Filtering; Enhanced Color Adjustment; Enhanced Color Management; Automatic Color Detection; Content or File Size Based Blank Page Removal; Fixed Thresholding; iThresholding; Lone Pixel Noise Removal; Majority Rule Noise Removal; Halftone Removal; Electronic Color Dropout (R, G, or B); Predominate (1) Color Dropout; Multiple (up to five) Color Dropout; Dual Stream; Compression (Group 4, JPEG); Image Merge |

| Barcode Reading |

One per page: Interleaved 2 of 5, Code 3 of 9, Code 128, Codabar, UPC-A, UPC-E, EAN-13, EAN-8, PDF417 |

| File Format Outputs |

Single and multi-page TIFF, JPEG, RTF, BMP, PDF, searchable PDF, PNG |

| Throughput Speeds |

Up to 40 ppm at 200 dpi and 300 dpi / 40 ppm simplex, 80 ipm duplex |

| Recommended Daily Volume |

Up to 5,000 pages per day |

| Recommended PC Configuration |

INTEL ATOM D525/D2550, 1.8 GHx, 2 GB RAM |

| Maximum Document Size |

216 mm x 356 mm (8.5 in. x 14 in.); Long Document Mode: up to 3 meters (118.1 in.) |

| Minimum Document Size |

63.5 mm x 65.0 mm (2.5 in. x 2.56 in.); Minimum width: 50.8 mm (2.0 in.) when centered using visual guides |

| Paper Thickness and Weight |

34–413 g/m2 (9 to 110 lb.) paper |

| Feeder |

Up to 75 sheets (20 lb./80 g/m2) paper; handles small documents such as ID cards, embossed hard cards, business cards, and insurance cards |

| Document Sensing |

Ultrasonic multi-feed detection; Intelligent Document Protection |

| Optical Resolution |

600 dpi |

| Output Resolution |

100 / 150 / 200 / 240 / 250 / 300 / 400 / 500 / 600 / 1200 dpi |

| Illumination |

Dual LED

|

| Power Consumption |

Off/Standby/Sleep mode: <0.5 watts; Running: <21 watts; Idle: <14 watts |

| Dimensions and Weight |

Height: 246 mm (9.7 in.); Width: 330 mm (13 in.); Depth: 162 mm (6.3 in.); Weight: 3.2 kg (7 lbs.) |